Gamification is a powerful tool that can enhance performance and growth in finance, law, and accounting. By applying game mechanics to non-game contexts, it drives engagement and motivation. This article highlights the benefits of gamification and offers five strategies for financial and legal professionals to implement. These strategies include referral contests, financial education quizzes, thought leadership contests, and more. Gamification can increase engagement, improve knowledge retention, foster collaboration, provide real-time feedback, and support continuous learning and development. By embracing gamification, professionals can create an exciting and dynamic workplace culture while empowering their teams to succeed.

Outsourced and Fractional Chief Marketing Officer (CMO) for RIA’s and Financial Firms

Why you may want to outsource your Chief Marketing Officer Role to a full agency that focuses exclusively on the financial and legal industries, rather than looking to do it all inhouse. This article is about financial advisor marketing through a wealth management marketing agency that can help you, with a CMO and entire team of experts.

Liquid Death: A Case Study on Branding Water

A branding case study on turning a mundane product or service into a rebellious, heavy metal-inspired brand that resonates with consumers. Dive into this fascinating case study and uncover the power of daring to be different, embracing authenticity, and disrupting traditional marketing norms, and learn lessons on applying it to your financial, legal or accounting practice.

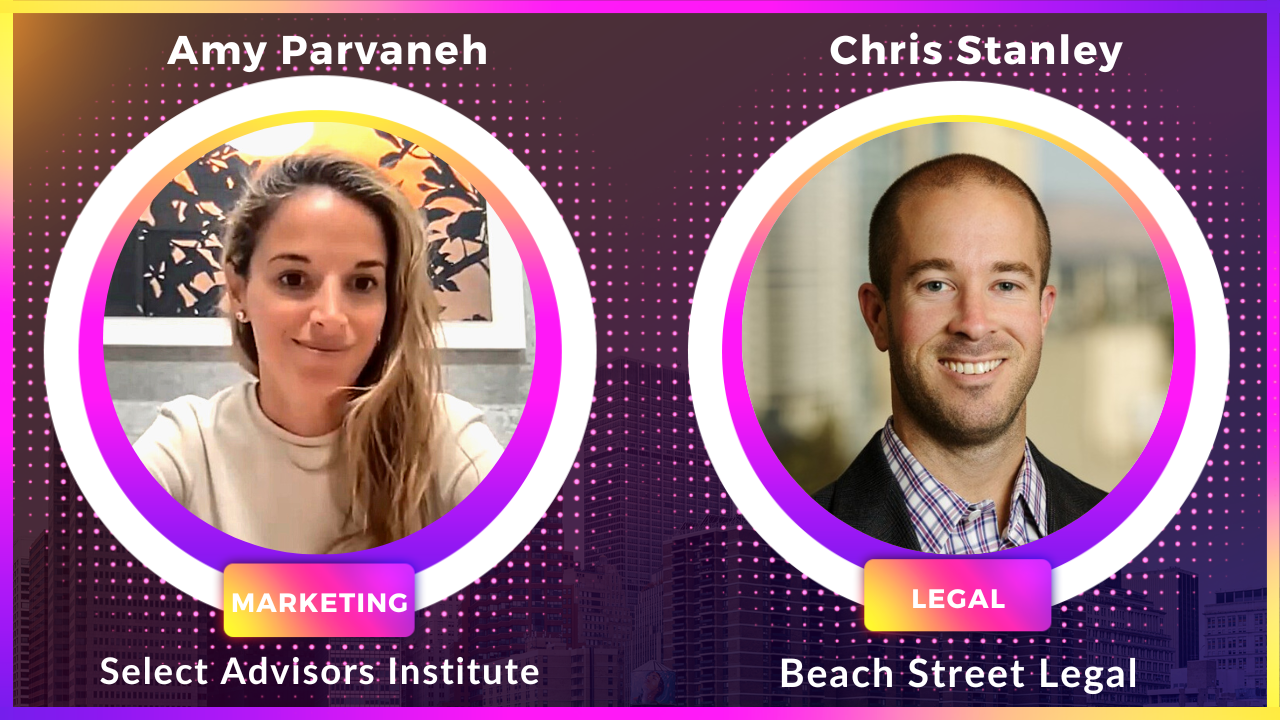

SEC Marketing Rule, Rule 206(4)-1 of the Advisers Act

Advisors are starting to be modernized to the 2020’s by the SEC! In this video interview with attorney Chris Stanely, we learn more about the details of the new adopted amendments to Rule 206(4)-1 under the Investment Advisers Act of 1940 (the Advisers Act) to modernize the regulation of investment adviser advertising and solicitation practices. More importantly, we discuss how to maximize these updates for your practice’s marketing efforts!

The Good the Bad and the Ugly of the Super Rich UHNW

Best questions to ask your team during your sales/pipeline review meetings

The Most Private of Private Members' Clubs

Salary and Compensation Rates at Family Offices and RIA's

Amy in Barron's Podcast: How to Motivate Advisor Teams With Creative Compensation

Amy Parvaneh was recently published in Barron’s, and recorded for Barron’s Advisor Podcast, about compensation and pay packages that are most suitable for advisory teams and firms around business development. In the recording, she discusses the downfalls of the traditional revenue split, and how to best align your team’s roles and responsibilities (including around business development) with their personality.

Wealth Management Firms: Different Compensation Structures for Your "Sales" Team

Should You Rename Your Advisory Practice?

Choosing a name for your practice should not be taken lightly. Name ideas for a wealth management practice are aplenty, but most advisors seem to lean towards the same style and approach, which can be hurting them in the long run. Read this about the art of naming a new or existing advisory practice!

Sports Sponsorships for Financial Businesses: What Are the Key Considerations?

Advisory firms are always seeking ways to expand their brand recognition. One avenue that deserves series consideration is Sports Sponsorships and Marketing. This article discusses how sports sponsorships can help you reach a major new category of eyeballs, but is it always worth it? Let’s find out!

Should you add a Family Office to your wealth management firm?

In this video, I discuss the future of the wealth management arena given the advent of AI, as well as discuss how wealth management firms can take advantage of adding Family Office services to their practice. What are family office services beyond investing, tax and legal? What other services should you add to your wealth management firm to truly stand apart from the competition?

How to embrace Succession’s "Quiet Luxury" for your Branding and Marketing

What is considered Ultra High Net Worth? Let’s start with CentiMillionaires!

The phrase “ultra high net worth” has gotten diluted. What is considered ultra high net worth? This article discusses one category of UHNW and that’s the CentiMillionaire Club, people with over $100MM in investable assets. People you want to have as clients! Learn everything you need to know about them!

Should You Hire an External CEO as Your Succession Plan?

5 Client Segmentation Structures to Revolutionize Your Advisory Practice

Feeling overwhelmed about the lack of categorization and organization in your client base? Given two finite resources, time and labor, as an RIA, wirehouse advisor or tax advisor, it’s important to put clear lines between the types of clients you serve and want to acquire, the service quality you provide to each, and your fee plans.

Why now is the most crucial time for advisors to send out a Net Promoter Score (NPS) Survey

Unique and Different Fee Structures Financial Advisors Can Embrace for Their Practice

Tired of the old-fashioned fee-based model for charging your clients, where you charge a percentage on the assets that you manage? Are you losing opportunities because some prospects just want to pick your brain without giving you all their assets to manage? It may be time to revisit your fee structure and come up with unique pricing models for your RIA and wealth management practice. In this article we discuss 10 unique pricing and fee structures for RIAs.

As seen in Kitces: Why The Best Sales Training Approach Depends On Your Unique Sales Personality Style

Read our latest white paper published on the Michael Kitces website. Sales training programs should be designed around an advisor’s specific personality type. Learn about the three Consultative Sales Personalities our firm has identified, and specific strategies each of those personality types can employ to turn your unique challenges into business development advantages.